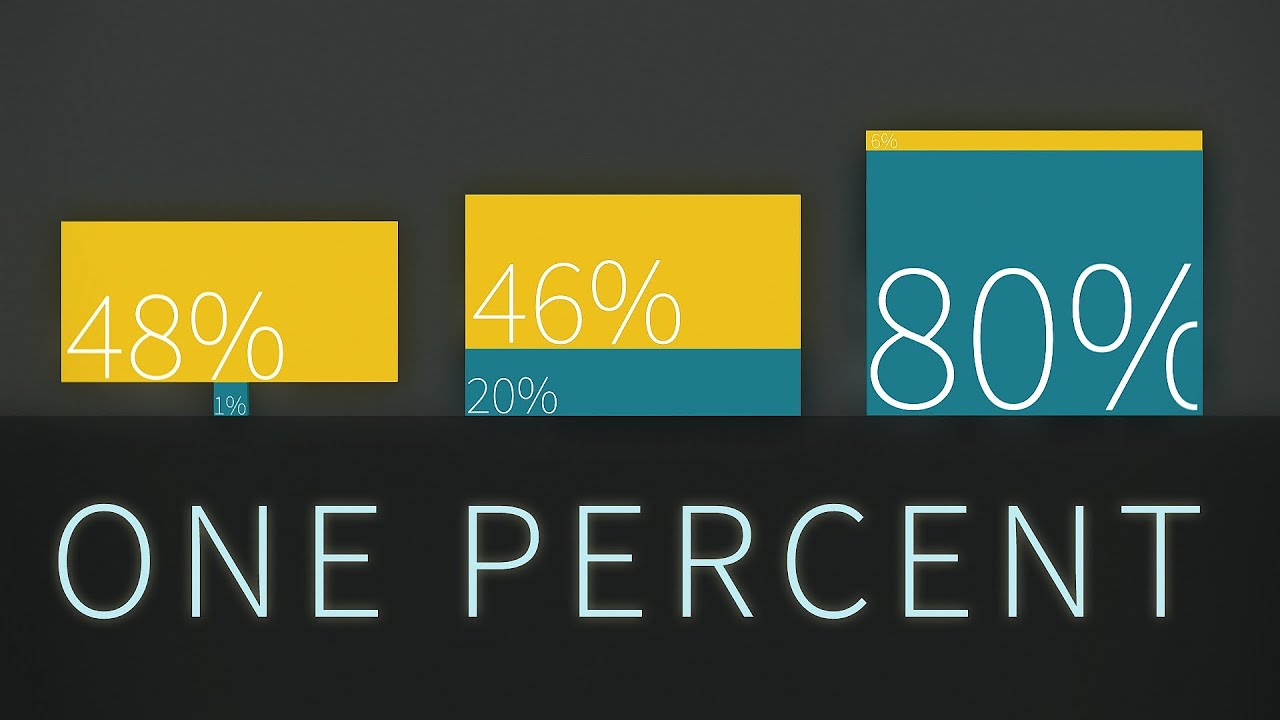

Almost a quarter of UK household wealth is owned by just 1% of the population. That’s according to new analysis which suggests we have historically underestimated the significant levels of inequality in this country.

According to the research, the top 1% hold nearly £800 billion more wealth than disclosed by official statistics. This means that inequality levels in the UK are likely to be much higher than previously thought.

In fact, the researchers say that the extra £800 billion in wealth is only a conservative estimate and it could be much, much more.

In this video, I’m looking at the research from the Resolution Foundation think tank, and considering what it means for high and rising levels of wealth inequality in the UK. Is it really such a bad thing that the top 1% own so much?

Subscribe to our YouTube channel:

—

Martin Bamford is a Chartered Financial Planner, Fellow of the Personal Finance Society and Director of Client Education at Informed Choice.

He’s author of three bestselling personal finance books:

The Money Tree:

Brilliant Investing:

How to Retire 10 Years Early:

Martin is a co-author of Harriman’s New Book of Investing Rules:

Martin is responsible for investment management research at Informed Choice and is our media spokesman. He is the host of the popular Informed Choice Radio podcast:

Listen on Apple Podcasts:

—

We help people just like you find answers to the big financial questions, making sure you can live a meaningful life as a result.

As an award-winning firm of Chartered Financial Planners working in Cranleigh and Petersfield, we know a thing or two about Independent Financial Planning.

Our team of Financial Planners use their knowledge and experience to deliver impartial and unbiased independent financial advice which will remove stress, bring your goals closer and deliver real financial security.

Website:

Follow us on Twitter:

Informed Choice on Facebook:

Informed Choice Ltd. Authorised and regulated by the Financial Conduct Authority.

The guidance contained within this video is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.

The value of your investments and the income from them can go down as well as up and is not guaranteed at any time. You may not get back the full amount you invested. Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.

—

Here’s the kit we use to create our videos (affiliate links):

Canon M50 camera:

RodeLink wireless microphones:

DJI Ronin SC gimbal:

source