Featuring Scott Winship, Executive Director, Joint Economic Committee; Chris Edwards, Director of Tax Policy Studies, Cato Institute, and Editor, DownsizingGovernment.org; moderated by Jeff Vanderslice, Director of Government and External Affairs, Cato Institute.

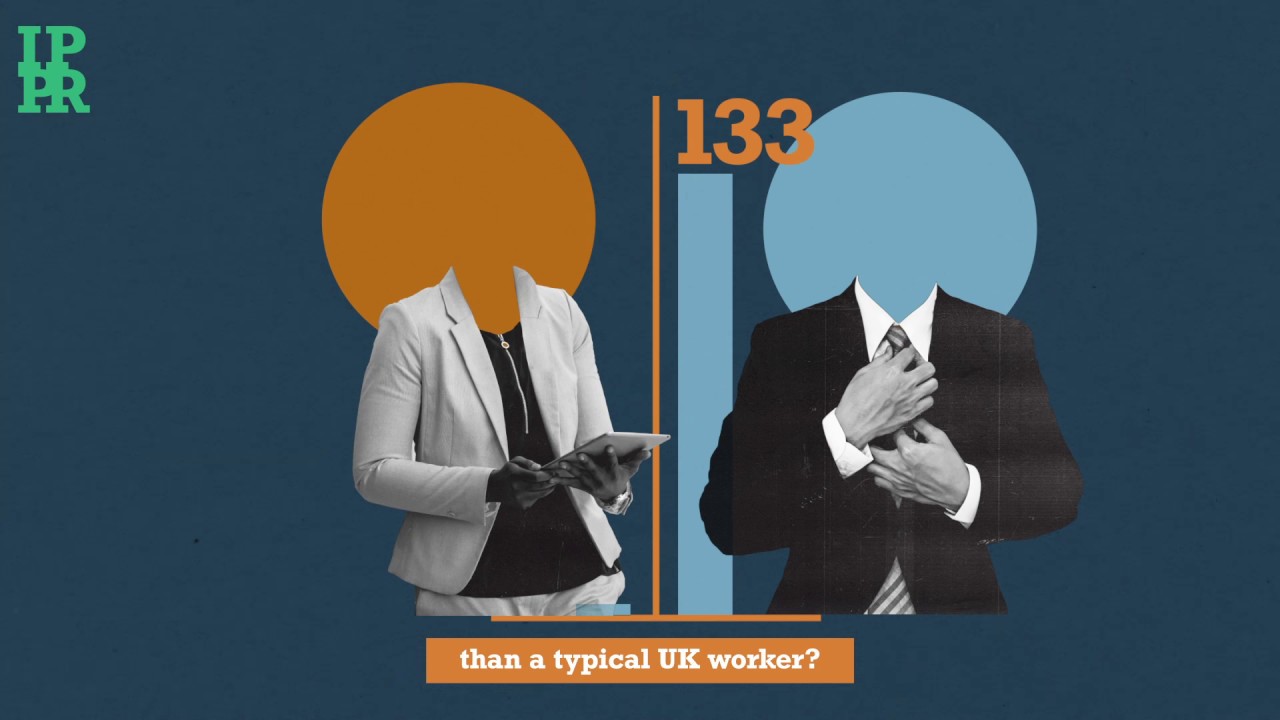

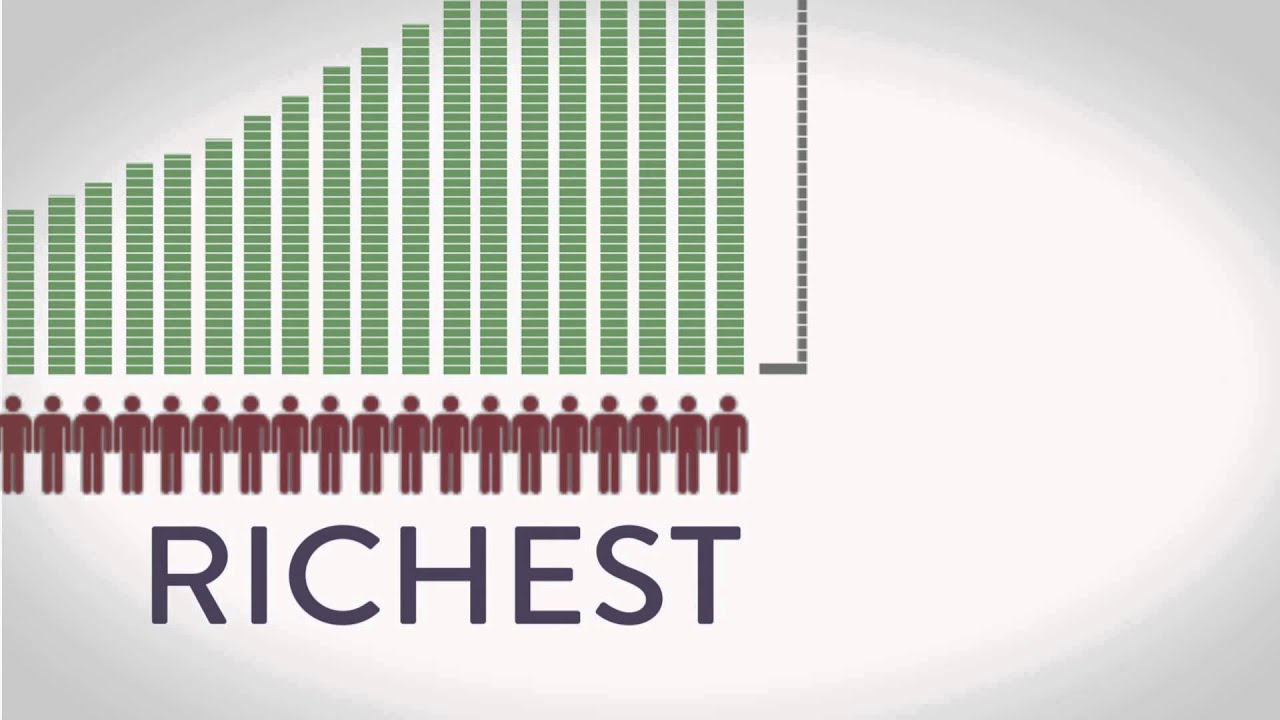

Some political leaders are saying that inequality is at unacceptable levels and should be countered by higher taxes at the top end. But income and wealth inequality are complex issues that are often misunderstood. Scott Winship is a long-time expert on inequality and economic mobility and will discuss income inequality. He will be followed by Chris Edwards, who will discuss wealth inequality data, the role of wealth in the economy, and the possible effects of an annual wealth tax.

Winship is executive director of the Joint Economic Committee, chaired by Senator Mike Lee (R-UT), and leads the committee’s Social Capital Project, a research effort aimed at understanding the health of families, communities, and civil society. The chairman’s office recently released a study comparing measures of income concentration. Edwards examined wealth taxation in a recent Cato study and has completed a new Cato study on wealth inequality with Cato scholar Ryan Bourne.

Learn more:

Want to find the Cato Institute elsewhere on the internet?

Facebook –

Twitter –

Instagram –

–

source